Consumer's Guide to Establishing Excellent Credit

With the start of the new year, many of us have vowed to establish goals to help improve our current financial situation. Regardless of your specific goal, they all tie back to a better financial future for you and those you support.

Everything you do financially ultimately ties together and can have an impact (for the better or the worse) on your goals. So if you dig down deep enough, you will realize that financial goals often involve a comprehensive focus on financial wellness: enhancing your credit score, building or maintaining a savings and investment strategy or paying down debt. You will find is that credit plays a large role in all of those things.

Looking to buy a house? They look at your credit score.

Looking to apply for a credit card? They look at your credit score.

Looking to finance a large purchase like a car or home renovation? They look at your credit score.

How are Credit Scores Calculated?

Reference: How are Fico Scores Calculated? [www.myfico.com]FICO is the most widely used credit score. It is used by approximately 90% of the top lenders in the country to assist with decision making during the lending process. FICO Scores can range from 300 to 850. Essentially, the lower your credit risk, the higher your score.

Reference: How are Fico Scores Calculated? [www.myfico.com]FICO is the most widely used credit score. It is used by approximately 90% of the top lenders in the country to assist with decision making during the lending process. FICO Scores can range from 300 to 850. Essentially, the lower your credit risk, the higher your score.

There are several factors that come into play that determine your riskiness. In order to have a score, there has to be enough information for the credit bureaus to calculate a score. In most cases, that requires at least one open account for at least six months.

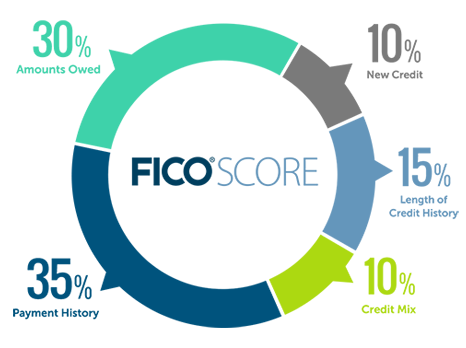

The exact formula utilized to determine your credit score is unknown, but FICO disclosed various metrics that are utilized in the calculation: New Credit, Amounts Owed, Length of Credit History, Credit Mix and Payment History. The most significant portion belongs to payment history and the second is the amount of debt you carry.

So, what can you do to establish excellent credit and assure that anything you plan on doing in the future with your finances is a possibility? Well, there are tons of articles all over the internet that provide suggestions on how to improve your credit or maintain excellent credit. We compiled a few different lists from across the internet and created a guide including ten suggestions to help you establish excellent credit.

1. Build and maintain a healthy savings account.

If establishing a savings isn't already a priority for you, it should be the first thing on your list this new year. Although a savings account, or the amount you manage to put aside in that account, doesn't directly impact your credit report, it's impact is widespread.

"Credit issues arise from people unable to pay their credit obligations." So if you don't have an emergency savings established for unexpected situations, like a medical emergency, long-term illness, major home or car repairs, you are more likely to turn to a credit card when you receive the bill.

Did you know? It may take 6-12 months or longer to recover from a loss of income. Unfortunately, your bills and obligations do not get put on hold to give you the time necessary to catch back up.

This is exactly why establishing a savings account, separate from your retirement, college or investment savings, is essential. More so, having those funds available when/if the unexpected becomes a reality will help make your financial obligations less of a burden and help you avoid the addition of more debt and financial stress.

Establishing a savings account doesn't require a large contribution each month. Start by reviewing your spending and determining unnecessary expenditures. Use the money spent on those unnecessary things to start building your savings.

Even better? Find a high-yield savings account that will allow your money to grow just by sitting in it. For example, SSB has a great Money Market Product, or even a Christmas Club Account, that both provide competitive interest rates.

2. Establish a budget and stick to it.

It's easy to establish a budget, but it's not nearly as easy to stick to it. If you are looking to achieve an excellent credit score, it is likely going to take some hard work and some sacrifices. Ultimately, you should establish a budget that you can live on until you reach your goal, cutting out all the money wasting habits from your daily routine.

The first step to establishing your budget involves taking a close look at your individual spending habits and understanding your strengths and weaknesses. SSB has a great online program full of tools and resources that will help you learn more about budgeting if you need a good starting point.

Remember, this doesn't have to be permanent. Depending on where you stand in relation to reaching excellent credit, you may or may not have to excessively cut spending. Regardless, gaining a better understanding of your spending and living a life with a budget in mind is never a bad thing. It's a lifelong skill that you can carry with you.

3. Use your credit, but don't abuse it.

If you are looking to rebuild your credit, you want to avoid increasing your debt. It is a myth that you have to carry debt on credit cards, loans, etc. to improve your credit scores.

The key is utilizing your credit and paying it off consistently, month after month. If you choose to charge small amounts to a credit card each month, pay it off each month to help you build excellent credit over the long-term. This will establish a positive payment history.

Too often, we look to credit cards to fund large purchases that we wouldn't have the funds to cover otherwise. This can get you into trouble because you end up with a large balance that you will struggle to pay off. Don't put yourself in a situation to feel unnecessary financial stress.

4. Maintain low to no balance on credit cards.

FICO published a report on the habits of people with excellent credit. As part of the report, they found that consumers with 7% or less utilization of available credit had the highest credit scores. This is a quick way to see improvements in your credit.

If you have multiple credit accounts, you should avoid carrying a balance on a majority of those accounts. Carrying zero balance on most of your credit accounts is not only helpful to your credit, but essential in working toward excellent credit. FICO likes to see a debt-to-limit ratio of 30% or lower (which is considered "good") in order to see improvement in your credit score.

5. Avoid maxing out your credit cards.

Use your credit cards wisely. Using 100% of your available credit means you've "maxed out". Maxing out even one card can kill your credit score immediately. FICO takes in consideration your overall credit utilization and individual utilization on each credit account.

As mentioned above, you don't want any one credit card to have more than 30% credit utilization or you will see a dip in your credit until the next cycle where the amount is paid down. So a great first step in working toward excellent credit would be paying down higher balances to below the 30% utilization threshold.

There are some credit cards that have balance transfer offers that could allow you to "spread out" the debt onto more than one card, helping to lower your utilization on a single card. For example, SSB Bank has an introductory balance transfer offer on our credit cards that allows individuals to earn 0% APR* on their balance transfer for 11 billing cycles or 12 months.

6. Don't miss a payment- Take advantage of autopay.

Good credit isn't about being perfect, but the key is striving to get as close as possible. We are all human, though, so mistakes are bound to happen. It is important to use the tools available to you to minimize the possibility of making those mistakes; Autopay is one of them.

Payment history accounts for 35% of your FICO score, so paying on time is crucial. When you setup autopay for your credit accounts, it will ensure that you remain in good standing with your lenders. Setting up your autopay may take a few minutes of your time, but it will save you time (and stress) each month by removing an extra "to-do" off your list. It provides a safety measure to avoid late fees, damage to your credit score and the need to accumulate additional debt

Additionally, rather than choosing the minimum for your automatic payment, pay more than the required amount each month- every dollar counts. This ensures that you put more money back in your pockets by paying off debt sooner. If it isn't possible to pay more than the minimum, making the payment is better than missing it.

One strategy to manage your autopay could be setting up a checking account specifically for your monthly autopays. If you use something like the Free Checking Account at SSB Bank, there are no minimums, no fees and the capability of setting up bill pay through our online and mobile banking apps. It's that simple.

7. Establish a banking relationship at a local, community bank.

Unlike the "big banks", local, community institutions have the ability to be more flexible with their customers. In your situation, they may have products or services available to help you build you credit. Additionally, by establishing a relationship with your bankers, you will gain a trusted resource that can help you plan with the future in mind. They are looking to keep you as a customer for the long term, so it's not just about the transaction for them, it's about providing an experience that keeps the customer satisfied.

To reinforce #1 above (establishing a savings account), having a bank account will complement your credit goals and help you to build a strong financial foundation for the future. At SSB Bank there are a variety of products available to help you establish or enhance your credit including savings and checking accounts, CDs, credit cards and lines of credit. In some cases, an established relationship could provide you access to

Community banks like SSB don't just rely on impersonal credit scores, either. We look at things one customer at a time and take your needs in consideration when you make a lending or banking inquiry.

So unlike the bigger players who quickly say "no", we take the time to assess what we can do to help. Why? Because here, we're a relationship banking institution. There are definitely strategies and products we can provide that will help you reestablish your credit and make your way to excellent credit over time.

Don't believe us? Check out our article outlining why community banks like SSB Bank are better.

8. Dispute negative credit claims.

Negative items on your credit report will typically remain on your credit history for 7 to 10 years. In most cases, the most recent negative items will have a greater impact on your score, so they should take priority when disputing claims.

Whether you complete your dispute online, through handwritten letter or over the phone, addressing it rather than letting it go is important. In most cases, having your dispute documented in writing is proof of your initiative to get things straightened out. There are a variety of strategies you can use to manage negative credit including paying for the deletion of collection amounts, disputing collection accounts, disputing late payments, removing tax liens or judgments or questing goodwill adjustments for late payments or paid charge-offs.

The key thing to remember is that this process can be lengthy and time consuming, but it can produce some desirable results. It is worth the time and energy if you want to improve your credit score and "make good" with the credit blunders you've made in the past.

9. Create a good mix of revolving and non-revolving credit.

Having a good mix of credit is one of five categories FICO utilizes to calculate a credit score. Some of the types of credit they look for include credit cards, retail accounts, installment loans, finance company accounts and mortgage loans. Credit mix accounts for 10% of your score. When considering what type of credit would be most beneficial to "mix-in", look at the types of credit you already have reporting.

In most cases, having a mix of revolving and non-revolving credit could help improve your credit scores.

- Revolving Credit: Revolving credit account allows you to repeatedly borrow against and pay off a credit line without having to apply for a new loan. Examples include credit cards, personal lines of credit and home equity lines of credit (HELOCs). A credit card can be used for large or small expenses, whereas lines of credit are typically for financing major expenses, such as home models or repairs.

- Non-revolving Credit: Revolving credit cannot be used again after you pay it off. When you initially borrow the money, you agree to an interest rate and a fixed repayment schedule. Examples include student loans and auto loans.

10. Be in control of your credit scores by reviewing your credit report.

If you are not actively reviewing your credit report to look for blemishes or negative credit claims, you are giving away control of your credit score. You need to take an active role in the management of your credit score by reviewing your credit history consistently.

Request a credit report from the three major credit bureaus (Equifax, Experian and TransUnion) and check for errors. If you have a credit card, some companies offer a review of your credit through their online platforms. See if that is a possibility as well. Either way, you won't know if there's claims to dispute if you don't take an active role in credit history management.

Conclusion

Establishing good habits with your saving and spending is the first step to a bright and stable financial future. In regard to your credit, specifically, the key is to remain as close to status quo as possible. This isn't the time to make huge purchases and add to your debt pile. This is the time to batten down the hatches and attack your credit head on.

If you are reading this article, you are definitely in the right state of mind to start working toward credit excellence. The first step is recognizing that you need to improve and the next is taking action. So you've read this article, now go and apply what you've learned to your own situation. There is no better time than right now.

*See our credit card page for full disclosure information related to our introductory credit card offers.

More Like This

5 Tips to Lower Your Risk of Tax Identity Theft

1/30/2019Did You Know?Tax Fraud is broadly defined as having your personal information stolen and used to commit tax-related identity-theft. This can include using your personal information to file a tax return in your name and collect the refund you had coming without your knowledge. Over the last few...

What Should You Do After a Data Breach?

10/18/2017In light of recent news about data breaches, SSB Bank feels it is important for our customers to understand what they should do to protect their finances. These tips are useful if your information is involved in any kind of breach or hack. Understand what happened.If you suspect you may have been...

How to Check Your Credit Score for Free (and why you need to do it)

7/1/2017Your credit score is a significant factor in your ability to get car loans, home loans, business loans, credit cards and other forms of financing. It can even impact your ability to get an apartment or a job.Managing your credit score is critical to taking control of your financial wellbeing. But...