How to Prepare Financially for a New Pet

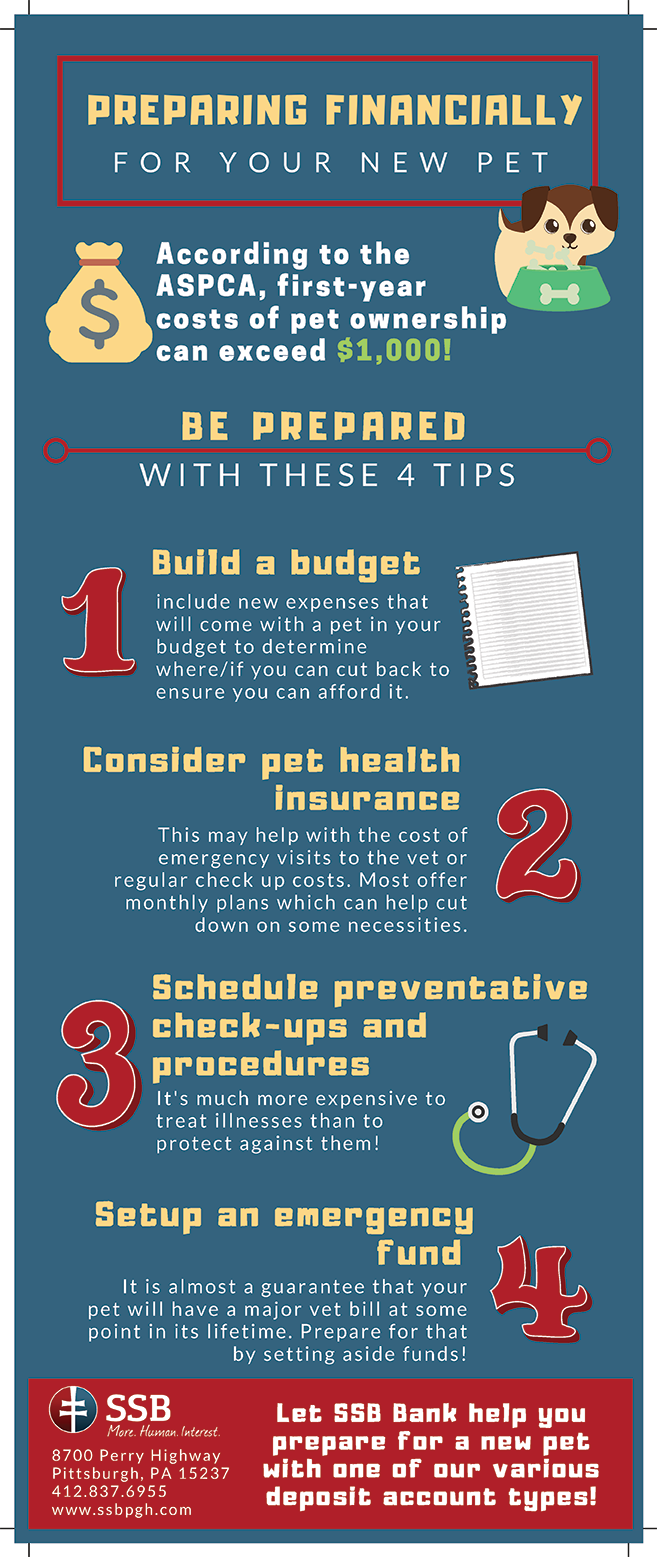

We’re big fans of adding furry members to the family! Last month, we hosted an Adopt-a-Pet event at our McCandless branch with Animal Friends to help some adorable little furballs find a home. Like any big decision, choosing to add a pet to the family works best when you take some time to plan ahead. The ASPCA estimates that the first year of pet ownership can come with $1,000 in costs!

Before you bring a new furry friend home, consider these four tips to help make the transition smooth for everyone and ensure your pet doesn’t become a financial strain over time.

1. Build a Budget

One of the best ways to plan for financial success in general is setting up a budget. Knowing how much money you have coming in and going out each month is the best way to make sure you’re able to plan for the additional costs that come with pet ownership.

If you don’t already have a budget, take some time to set one up for your expenses as they stand. Once you know what your monthly budget looks like, build in the costs that you’re adding with your new friend, including things like:

- Food and treats

- Toys

- Medications - even healthy dogs should have monthly preventative medications for heartworms, fleas, and ticks.

- Litter

- Vet visits

- Any walking or daycare services you may plan to use

- Beds or crates

- Adoption fees

Not sure where to begin planning your budget? Check out this list of free financial planning tools we compiled to help get you started!

2. Consider Getting Pet Health Insurance

A little planning can go a long way, but that doesn’t always account for unpleasant surprises like emergency vet visits. Even the healthiest pets need to go to the vet regularly to make sure they remain healthy and happy. One way to help ensure these costs don’t get out of hand is by adding pet insurance.

Just like health insurance for your human family members, pet insurance can come in different forms and at different costs. The ASPCA has a few great resources to help you get a better idea of the kinds of plans and coverage available.

3. Schedule Preventative Checkups and Procedures

The best way to keep pet costs down in the long run is by keeping up with all preventative measures to ensure your pet stays healthy. Staying current with your animals vaccines, preventative medications like flea and tick or heartworm, brushing their teeth, and regular vet checkups can help prevent larger (and more costly) problems from ever occurring.

By making healthy choices for your pet every day, you help them lead a happier, healthier life. You can check out this article by the ASPCA for more information about cutting costs through preventative measures.

4. Set Up an Emergency Fund

Finally, even the best planning efforts can’t take everything into account. Emergencies and unexpected costs are part of life! One of the best ways to plan for the "unplannable" is to set up an emergency fund. If you already have an emergency fund, consider adding to it or creating a separate fund for pet emergencies. That way, whether your dog chews through something they shouldn’t or your cat knocks an expensive item off of a shelf, you’re prepared to cover the curveballs that pet ownership can throw at you.

We're happy to help you adopt a pet!

Another great way to plan for adopting a new pet? Letting us help!

From different types of deposit accounts to planning for your financial success, our staff of friendly experts are ready to help you plan for your financial future and the future of your furry friends!

Get in touch with us today to find out more!